Introduction:

Once upon a time inside the bustling company landscapes of the USA and UK groups embarked on a dangerous journey through the treacherous seas of policies and requirements. Amidst the waves of change Compliância stood because the steadfast captain guiding ships appropriately to the shores of legal of criminal conformity and ethical exercise.

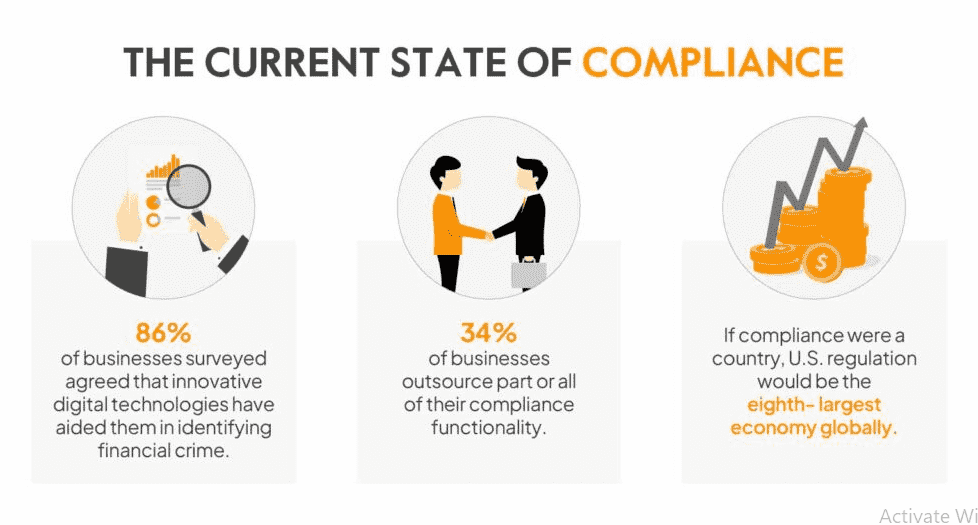

The Current State of Compliância

In current years the compliância enterprise has witnessed a extensive transformation. A survey found out that 70% of company chance and compliance experts have noticed a shift from take a look at-the-field compliance to extra strategic method. This evolution displays the growing complexity of regulatory environments where 83% of experts agree that compliance is a essential attention in choice-making processes.

Compliância as a Strategic Business Function

Far from being a mere responsibility 80% of experts view compliance as a valuable business advisory function. It’s not just about adhering to legal guidelines; it’s about allowing supporting and enhancing business activity.

Investment in Compliance

The investment in compliance is evident with 60% of executives feeling that their companies are dedicating greater sources to this region. This is a testament to the importance positioned on retaining regulatory standards.

The Cost of Non-Compliance

Ignoring compliance may be highly-priced. Organizations that fail to conform face no longer handiest prison repercussions but also damage to their popularity and believe with stakeholders.

The Financial Impact

The financial implications of non-compliance are remarkable. Service organizations record the need to demonstrate compliance with at the least six frameworks highlighting the sizable nature of compliance requirements.

Handle Compliance with Limited Resources

Handling compliance with limited resources can be challenging but there are some strategies to navigate this situation effectively:

Co-Sourcing Approach:

- Consider a collaborative approach with a trusted provider. Co-source tasks to a third party while maintaining ultimate responsibility for your compliance program.

- This allows you to advantages from their expertise efficiency and cost-effectiveness without giving up regulatory accountability.

RegTech Solutions:

- Leverage regulatory technology (RegTech) to automate manual tasks generate reports and capture data for record keeping purposes.

- RegTech can enhance operational efficiencies and streamline compliance efforts.

Prioritize Tasks:

- Identify critical compliance projects and prioritize them based on risk and impact.

- Allocate resources strategically to address high-priority areas.

Cross-Functional Resource Allocation:

- If resources are scarce leverage the right personnel across multiple business units.

- Evaluate where compliance efforts are most needed and allocate resources accordingly.

Stay Informed:

- Regularly monitor regulatory changes and industry trends.

- Adapt your compliance approach based on the evolving landscape.

Small Businesses Handle Compliance

Handling compliance can be challenging for small businesses but it’s essential for their success. Here we will explore are some strategies:

Education and Awareness:

- Small business owners should educate themselves about relevant regulations (e.g. tax laws industry-specific rules).

- Attend workshops webinars or consult experts to stay informed.

Risk Assessment:

- Identify compliance risks specific to your industry.

- Prioritize risks based on impact and likelihood.

Document Policies and Procedures:

- Create written policies and procedures for compliance.

- Include guidelines for employees on handling sensitive data safety protocols etc.

Technology Solutions:

- Invest in compliance software (e.g. GRC tools) to track and manage compliance tasks.

- Automate repetitive processes (e.g. payroll tax filings).

Training and Communication:

- Train employees on compliance requirements.

- Regularly communicate updates and changes.

Outsource When Necessary:

- Consider outsourcing compliance tasks (e.g. legal accounting) to experts.

- It can be cost-effective and ensures accuracy.

Compliance Management and Tools

With the increasing demand for compliance control tools and structures have emerge as important 59% of protection and IT leaders suggest their agency has a couple of structures to adhere to compliance requirements.

The Role of Automation

Automation performs a vital role in compliance management. It allows for chronic review of compliance controls making the procedure more efficient and much less liable to human mistakes.

(FAQ)s about Compliância

What is Compliância?

- Compliância originating from the Portuguese language refers to adherence to guidelines rules standards or laws. It encompasses both ethical integrity and practical honesty.

Why is Compliância Important?

- Compliância ensures that organizations comply with legal and regulatory requirements.

- It promotes ethical behavior prevents legal violations and maintains trust with stakeholders.

Are Compliância Prerequisites the Same for Every Industry?

- No compliance requirements vary across industries. Each sector has unique policies and requirements that companies should follow.

How Does Innovation Influence Compliância?

- Innovation impacts compliance by way of introducing new demanding situations (e.g. Information privacy in tech) and necessitating adaptable approaches.

Common Problems Businesses Face with Compliance:

- Lack of resources (financial personnel).

- Keeping up with evolving regulations.

- Balancing growth with compliance efforts.

Conclusion: The Future of Compliance

As we sail into the future the role of compliance stays crucial. With new policies at the horizon and the ever-gift threat of cyber risks groups must remain vigilant and proactive. Compliance isn’t always only a journey; it’s a vacation spot that requires consistent navigation.